IBEX 35 Holds Its Ground Against the DAX, but a Breakthrough Looks Challenging

Among the main European financial markets, only one seems able to keep pace with Frankfurt: Madrid. The Ibex 35 index has posted a year-to-date gain of over 21%, though that may not be enough to challenge the DAX’s dominance in the second half of 2025.

The strong performance of the Ibex 35 in 2025 is supported by a favorable economic backdrop in Spain, with expected GDP growth above 2% — the highest in Europe — and by still relatively low equity valuations compared to other European markets. The index’s average price-to-earnings (P/E) ratio stands at around 11.1 times earnings, significantly lower than the 14.5 times recorded by the Euro Stoxx 50.

Another important factor is dividend yield. The Ibex offers a high dividend yield, around 4.5%, making it much more attractive than the returns currently available from fixed-income instruments. This makes the Spanish equity market appealing to investors across the region.

According to analysts, the Ibex 35 still holds growth potential of between 16% and 20% for the full year 2025. Around 40% of experts currently recommend buying the index, supported by stable earnings expectations and a monetary policy stance from the ECB that continues to keep interest rates low — a favorable environment for financial assets.

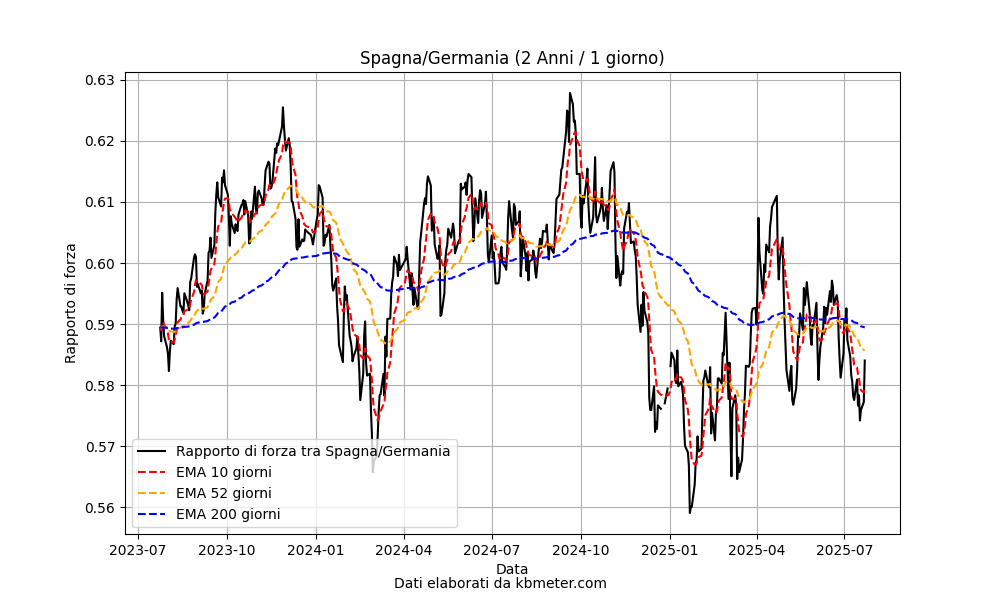

Looking at the relative strength ratio between the IBEX 35 and the DAX, we can see that the Spanish index began to recover against the German one at the start of 2025, though this momentum has slowed in recent weeks. From a technical perspective, a bearish signal has emerged with the 50-day moving average crossing below the 200-day moving average — a development that could undermine the possibility of the Iberian index overtaking its German counterpart in the second quarter of 2025.