A weak dollar gives wings to emerging-market government bonds

2025 is shaping up to be a weak year for the US dollar, and this is also affecting the bond market—particularly the performance of government bonds from emerging markets. Let’s take a closer look at the relationship between these two asset classes and the situation at the end of the first half of 2025.

Emerging market government bonds have a close relationship with the performance of the US dollar. When the dollar strengthens, these bonds tend to struggle; conversely, when the dollar weakens, their value often rises. The main reason is that many emerging countries issue debt denominated in US dollars. If the dollar rises, it becomes more expensive for these countries to repay their debts, as they must convert more of their local currency to obtain the same amount of dollars. This increases the perceived risk among investors, causing bond prices to fall.

On the other hand, when the dollar weakens, these countries benefit: debt servicing costs decline, perceived risk drops, and bond prices tend to rise. Additionally, for investors holding local currency-denominated emerging market bonds, a weaker dollar strengthens the issuing country’s currency, boosting total returns for investors in USD or EUR.

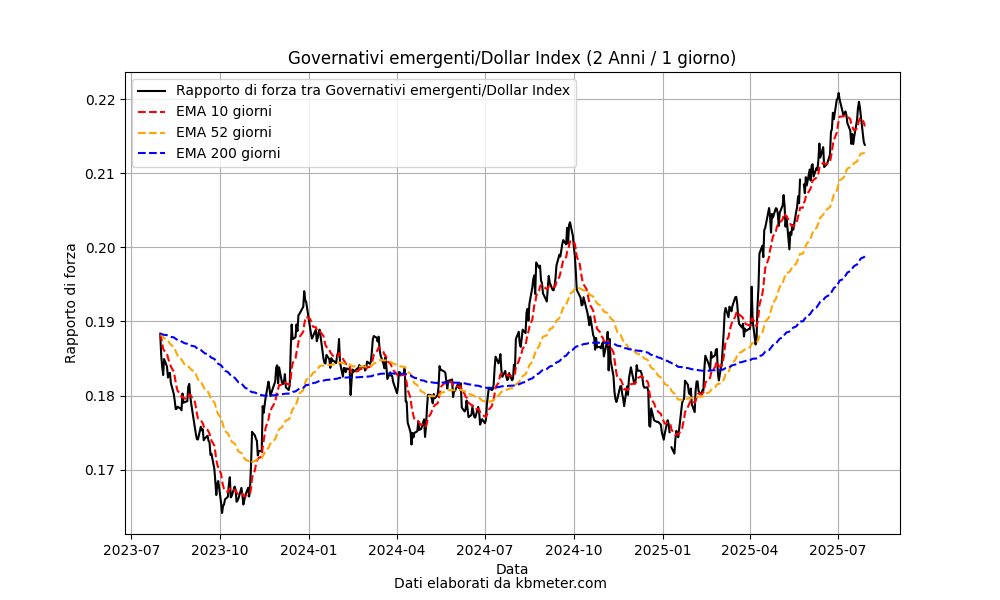

So what’s the current state of the balance between emerging market bonds and the US dollar? The chart above tracks the Bloomberg EM Local Currency Liquid Government Bond Index (as the numerator) against the Dollar Index (as the denominator). The indicator turned upward at the start of 2025, crossed above the 200-day moving average, and reached a two-year high by the end of June. In July, the situation stabilized, with the Dollar Index posting its first positive month since last December.

At this stage, there are no clear signs of a reversal, especially considering the increasingly likely scenario of interest rate cuts by the Fed and signs of moderate growth in the US economy.