A new leader emerges among European markets: Spanish equities

Over the course of 2025, Spanish equities have climbed the ranks of European stock markets, eventually overtaking Germany’s DAX at the top.

In 2025, the IBEX 35, Spain’s main stock index, posted a performance of over 30%, nearly double that of the DAX, 10 percentage points higher than Milan, and well above the EuroStoxx 600 (+around 9%). These are impressive figures in many respects, reflecting how Spain’s economy is emerging as a key player in the region.

Several factors have contributed to the “success” of Spanish equities. One of the main drivers is the strong sectoral composition of the IBEX, which is heavily weighted toward banking, utilities, and infrastructure—sectors that generate strong cash flows and substantial dividends, making them particularly attractive in a context of still-elevated interest rates. Another key factor is the stability of Spain’s macroeconomic framework, which places the Iberian country among the fastest-growing economies in the Eurozone.

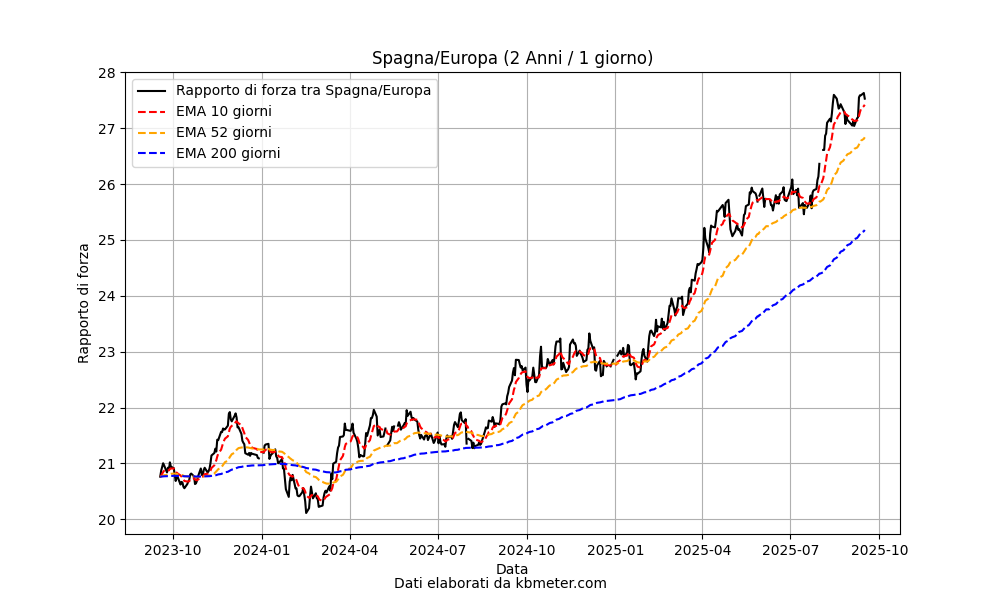

In the chart above, we can observe the relative strength ratio between the IBEX 35 and the EuroStoxx 600 over the past two years. The long-term uptrend has seen a marked acceleration starting from the beginning of 2025.

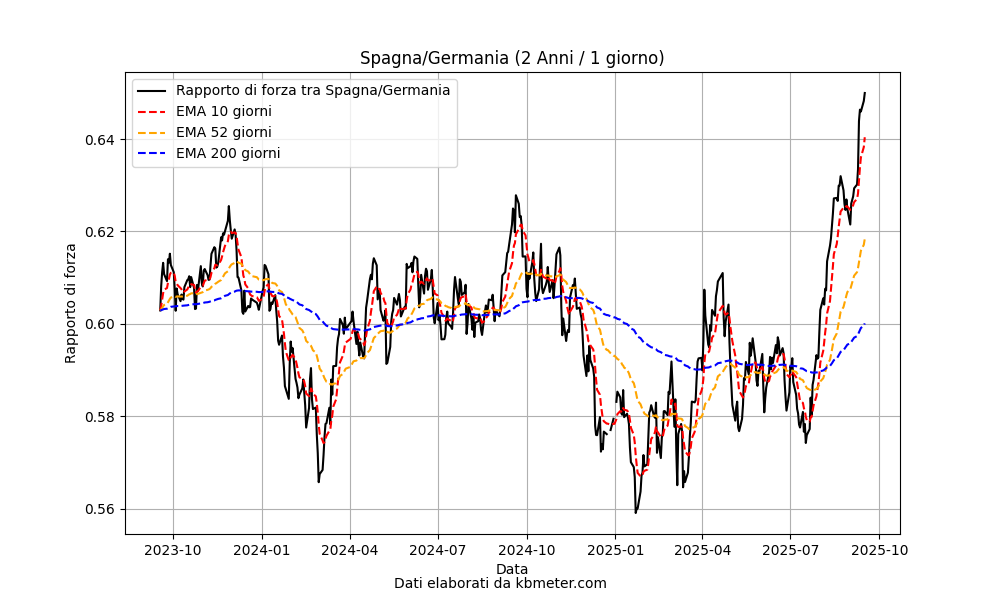

The German DAX, which had been dominant for much of the past two years, has experienced a slowdown. In the relative strength ratio between Spain and Germany, we can observe an acceleration since last July, accompanied by a bullish crossover of the 50-day moving average over the 200-day moving average.

As long as the European and global context remains uncertain, investors’ desire to diversify is likely to continue favoring “value” industrial sectors capable of generating stable dividends. In this regard, Spanish equities still appear to have room for growth. In the medium term, analysts expect the index to continue rising, potentially surpassing 19,000 points by the end of 2026, supported by moderate but stable economic growth in Spain and an improving global macroeconomic environment, including gradual interest rate cuts by the Federal Reserve.