Weak Dollar, Emerging Market Equities and Bonds Compared

The weakness of the dollar, driven in recent weeks by the Fed’s actions, has among its effects an appreciation of emerging market equities and bonds.

In general, it is worth remembering that a weak dollar can have positive effects on emerging financial markets by influencing several factors:

- Reducing the cost of external debt: A weaker dollar makes servicing dollar-denominated debt cheaper, improving the financial position of emerging markets.

- Increasing capital inflows: Investors may be attracted by higher yields in emerging markets, supporting investments in local equities.

- Boosting exports: A weak dollar makes products from emerging markets more competitive internationally, benefiting exporting companies and potentially increasing profits and stock prices.

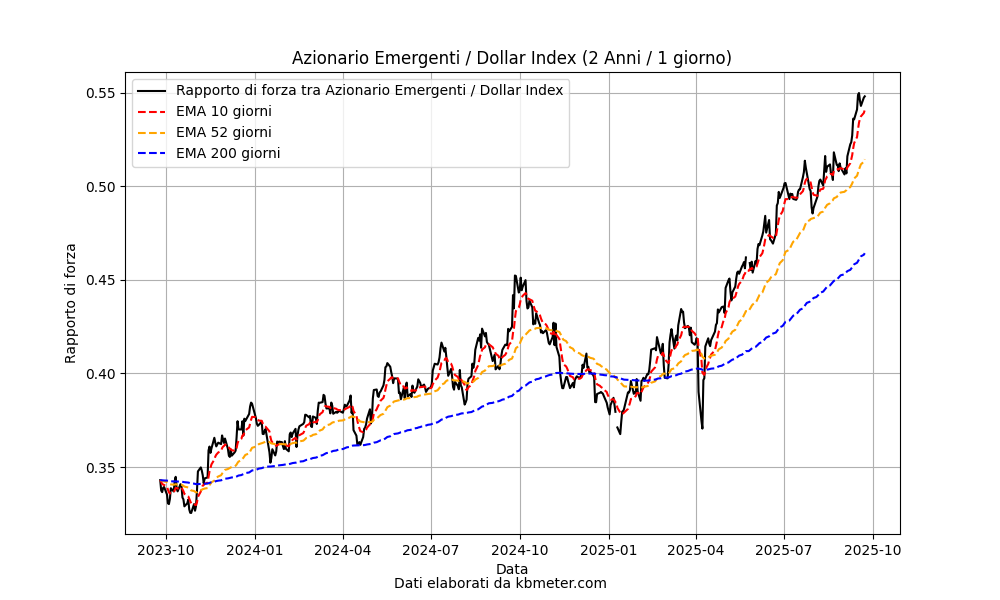

Below, we observe the trend of the relative strength ratio between emerging market equities and the dollar and note that the indicator has accelerated upward since last spring.

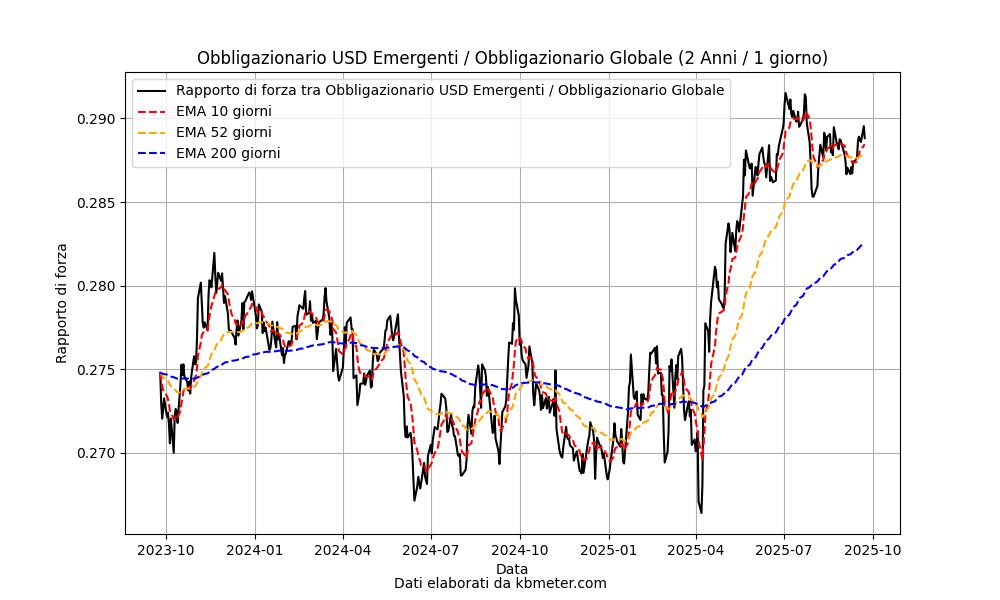

A similar trend is seen for emerging market bonds. Below, we look at the relative strength compared to global bonds, noting the sharp rise since last April, with the 50- and 200-day moving averages crossing to the upside.