USD Corporate Bonds Rebound Against Euro Counterparts in July

After a strong start to the year for euro-denominated corporate bonds, the trend appears to have reversed in recent weeks. However, European investors must take the exchange rate effect into account.

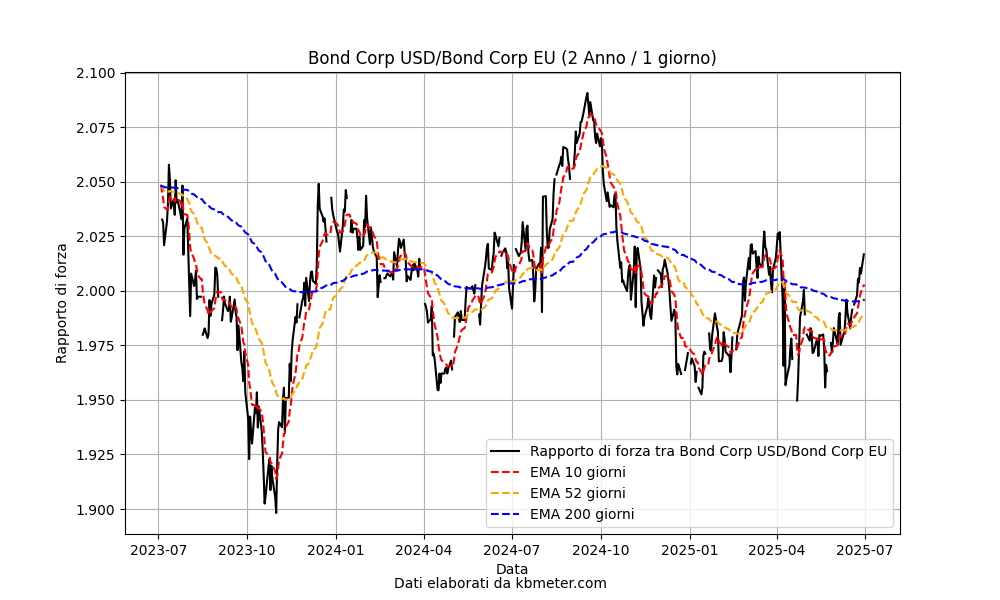

The chart above shows the relative strength ratio between USD-denominated and EUR-denominated corporate bonds. A prolonged period of outperformance by euro-denominated corporate bonds can be observed, starting in October of last year and lasting through early 2025. This is followed by a recovery in USD corporate bonds, which is temporarily halted around the so-called “Liberation Day,” amid rising inflation concerns and a more cautious stance from the Fed compared to the ECB. More recently, USD corporate bonds have regained strength relative to their euro counterparts, with the indicator crossing above its 200-day moving average and approaching the highs seen at the beginning of the year. Expectations of falling interest rates are driving the rally in dollar-denominated bonds, while in Europe, the ECB’s positive impact seems to have run its course.

The U.S. corporate bond market is currently experiencing a positive phase, but for European investors, this strength is partly offset by the weakness of the U.S. dollar against the euro, which negatively affects returns when translated into local currency (unless hedged instruments are used).