U.S. Small Caps: Premature to Signal a Reversal

Monitoring the performance of small caps relative to large caps can provide important insights into market expectations regarding economic growth and interest rate trends. The analysis of the relative strength ratio indicates a weakening of the downward trend, but it is still too early to talk about a true trend reversal.

Small caps typically tend to outperform in the early stages of an economic cycle, when interest rates and inflation are low or when there is optimism about the economy. Large caps, on the other hand, tend to hold up better during periods of uncertainty or global risk, thanks to their stability and international diversification.

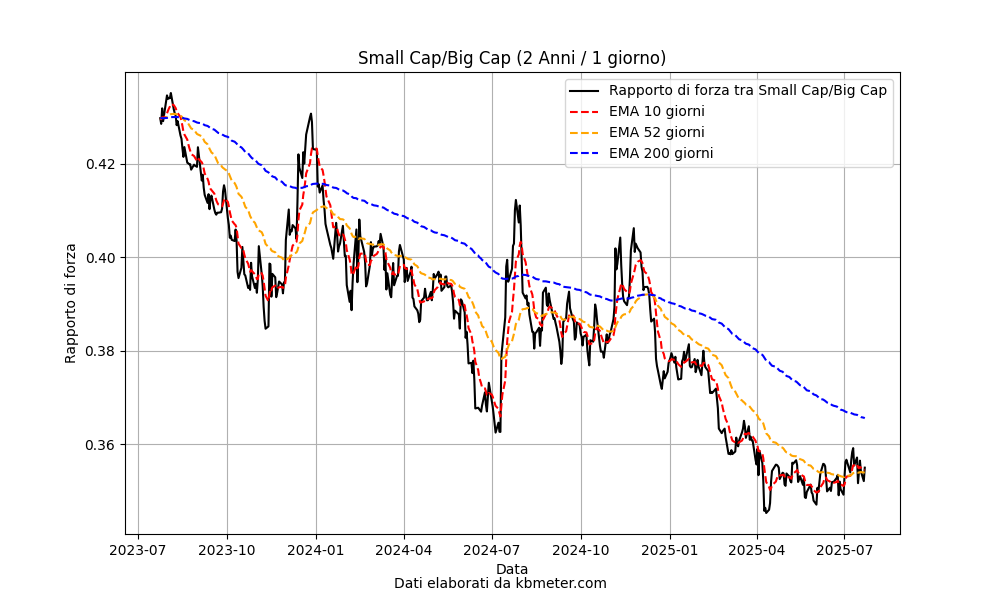

Let us therefore observe the performance of the relative strength ratio between U.S. Small Caps and Big Caps over the past two years (see chart above). First of all, we can observe the long-term downtrend, with a failed attempt at reversal toward the end of 2024. At present, the situation appears to be congested near the lows, with the 50-day moving average still well below the long-term average. The downward momentum seems to have run out, but it is still too early to speak of a potential trend reversal.

Small caps continue to struggle with the uncertainty surrounding the U.S. economic outlook and persistently high interest rates. A shift toward a more accommodative monetary policy — supported by encouraging inflation data — along with improved U.S. GDP figures in the second quarter, could provide a solid foundation for a recovery in U.S. small caps.