Turkey Trails Emerging Markets, but Investor Appetite Is Growing

Turkish equities continue to lag behind the broader emerging markets sector, but there are signs—at least in terms of investor interest—that something may be starting to shift.

One of the defining features of 2025 so far is the strong performance of emerging market equities.

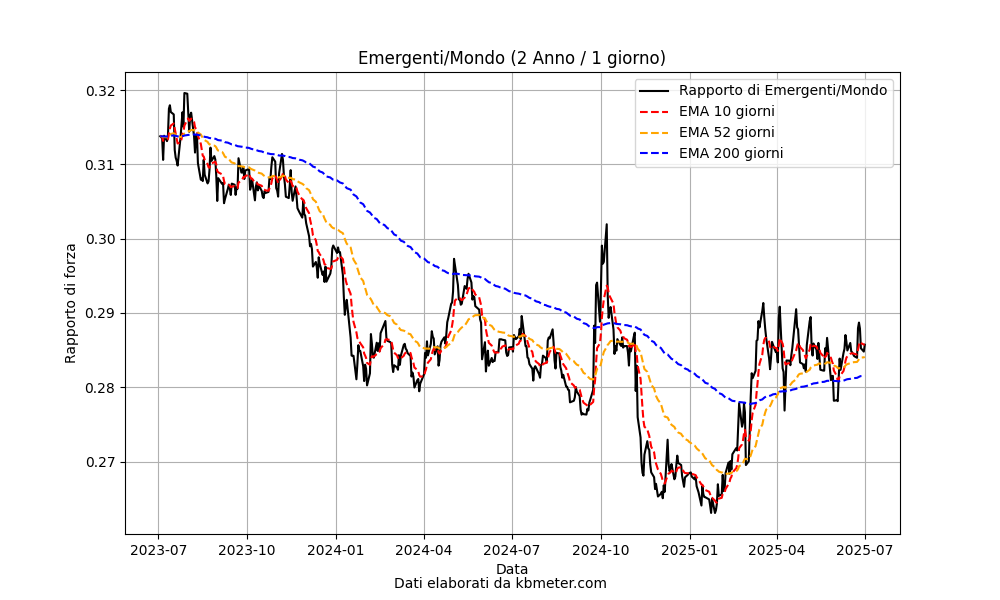

As seen in the relative strength ratio between the MSCI Emerging Markets Index and the MSCI World Index, a trend reversal has been underway since January, with emerging markets outperforming the global index.

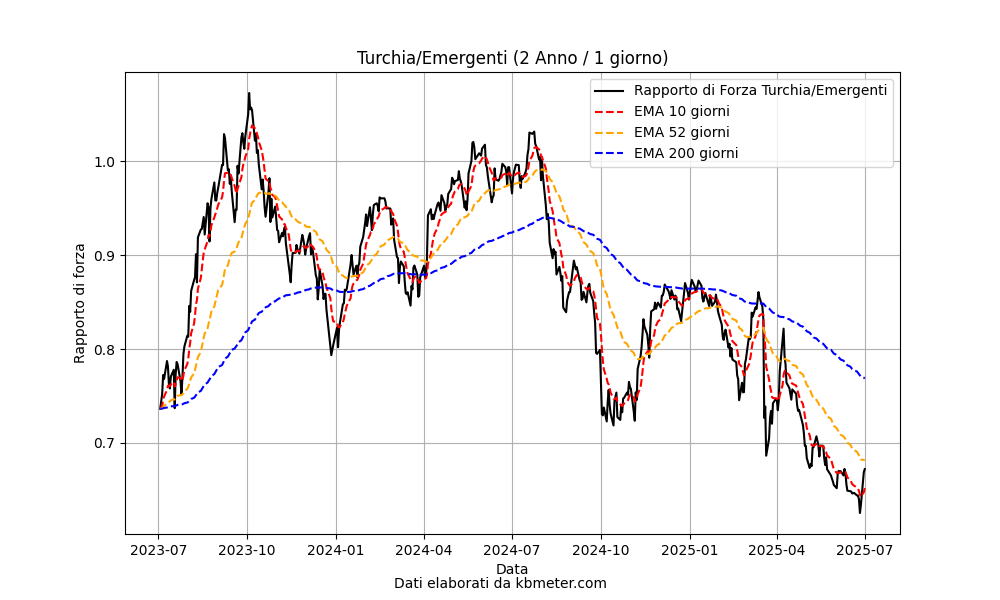

Among the emerging markets that have been left behind during this recovery phase is Turkey. However, there are signs that suggest potential change on the horizon.

Looking at the relative strength chart between the MSCI Turkey Index and the MSCI Emerging Markets Index, the prolonged period of weakness since mid-July last year is clearly visible. A first attempt at a rebound toward the end of 2024 was subsequently halted. Now, a movement recorded in June offers a glimmer of hope for a potential recovery.

That jump toward the 52-day moving average is partly driven by strong buying activity in the iShares MSCI Turkey ETF. According to Bloomberg, capital inflows into the ETF reached $21.4 billion in June—levels not seen since June 2023. Overall, Bloomberg also reports that net purchases of Turkish equities by institutional investors in 2025 are around $620 million, a significant improvement compared to the -$2.5 billion recorded in 2024.