Tech Sector Strength Fuels South Korean Equity Surge

Over the past 12 months, South Korea’s equity market, measured by the KOSPI index, has delivered a very strong performance: the index climbed above 4,108 points as of October 31, 2025, marking an increase of approximately +61.6% compared to the same period the previous year. All this with valuations that remain reasonably sustainable, with the estimated P/E ratio of the overall Korean market around 13.06 at the end of October 2025.

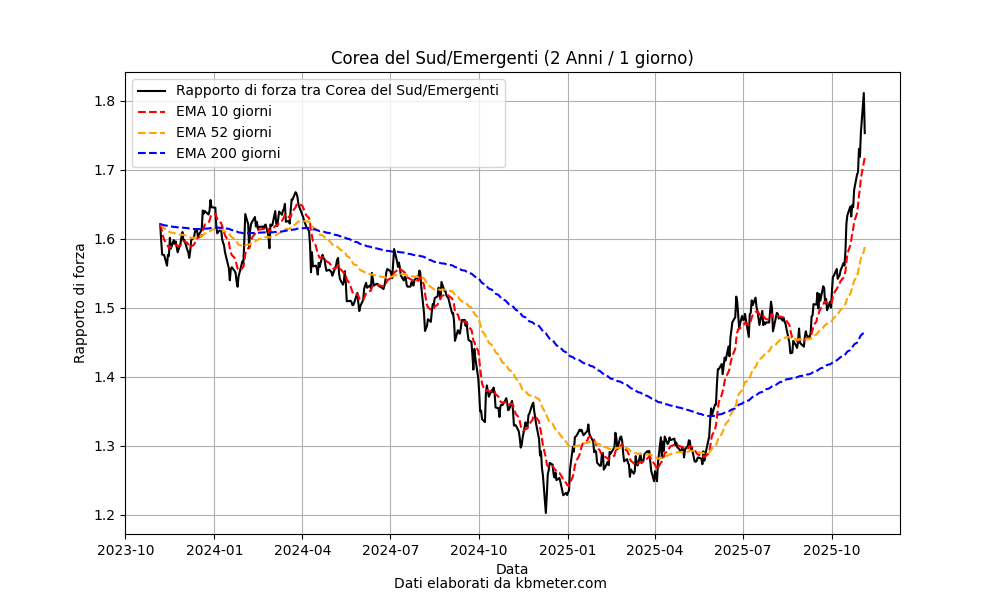

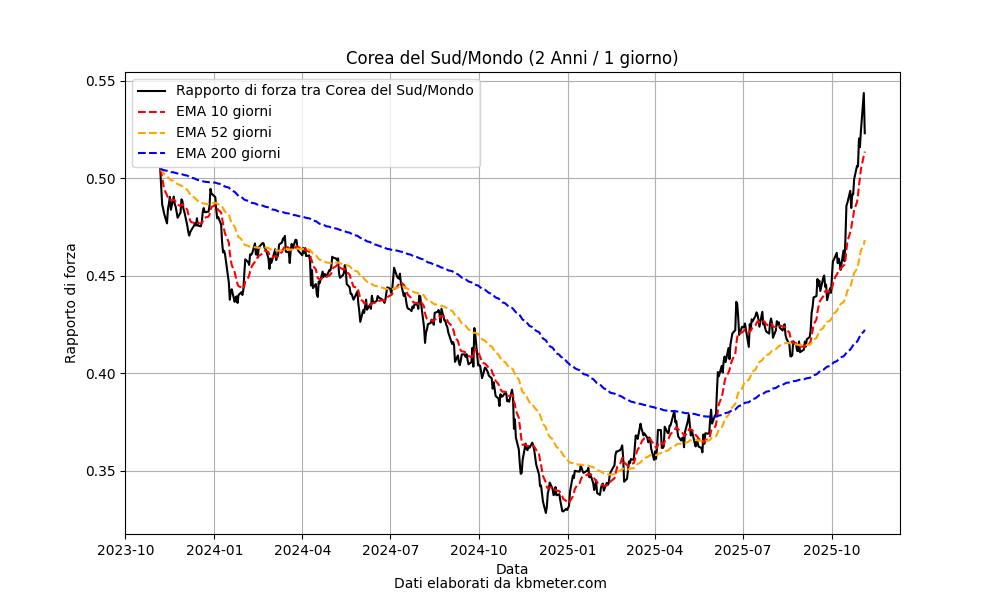

In the two charts shown above, we observe the performance of South Korean equities relative to emerging-market equities (first chart) and global equities. A clear upward acceleration is visible from early 2025, with an additional push at the end of summer. The indicators have registered a bullish signal, with the 50-day moving average crossing above the 200-day moving average.

This rally is closely linked to the performance of U.S. technology stocks and the global integration of the tech supply chain: academic studies indicate that U.S. equity market returns precede those of South Korea, meaning that movements in the American market tend to drive the Korean one. In particular, Korean companies—especially in the semiconductor sector—are an essential part of the value chain of U.S. tech giants: when U.S. big tech performs well, Korean supplier companies also benefit.

Additionally, Korean investors are allocating an increasing portion of their capital into U.S. tech stocks — it has been reported that the value of U.S. securities held by Korean retail investors has exceeded USD 100 billion, favoring names like Tesla.

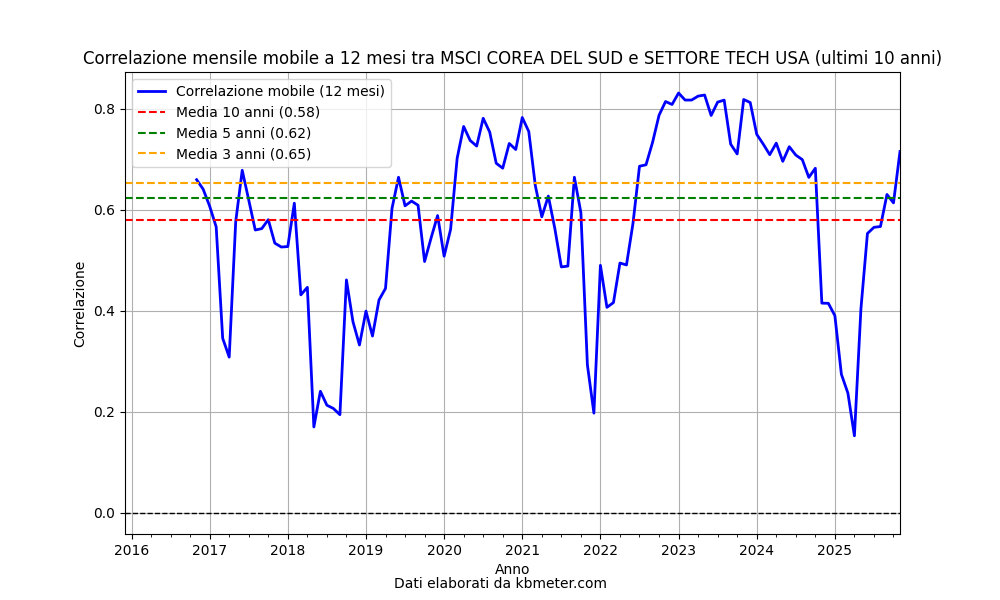

In the chart above, we observe the correlation between South Korean equities and the technology sector of the S&P 500. First, we note the current correlation level, above 0.8 and close to a nearly perfect positive relationship. Over the past 10 years, the indicator has consistently remained in positive territory with an average of 0.58.