Signals from U.S. High Yield and Small Caps: Fed Expectations Fall, Recession Risk Low

What can two market segments, particularly sensitive to U.S. monetary policy and economic growth, tell us? The analysis of U.S. High Yield bonds and Small Cap stocks seems to confirm a reduction in expectations for Fed rate hikes and a lower recession risk for the U.S. economy.

As a preamble, it is useful to recall how the performance of High Yield bonds and Small Cap equities can be interpreted. Speculative bonds benefit from a falling interest rate environment, which makes them more attractive, while an economic expansion helps reduce their risk profile. Small Caps are more sensitive to the economic cycle and respond positively to rising growth expectations and more accommodative monetary policies.

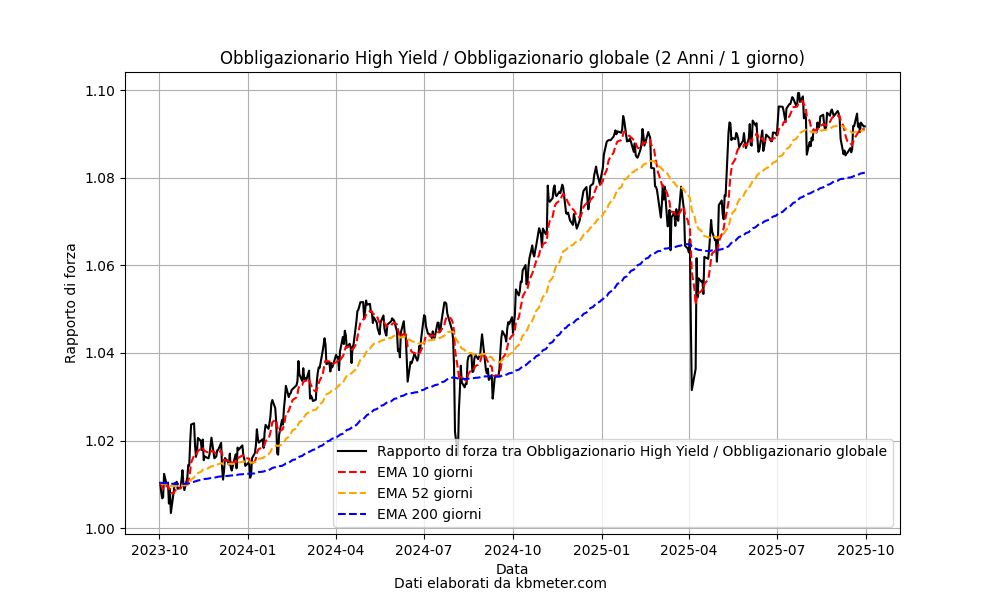

Let’s start by analyzing the high yield bond market. The chart above shows the relative strength ratio between this sector and the global bond index. Apart from the rapid sell-off in April, there is an upward trend indicating a positive phase for high yield compared to the broader index. However, in recent months, momentum appears to have slowed, with the 50-day moving average flattening and the market moving sideways.

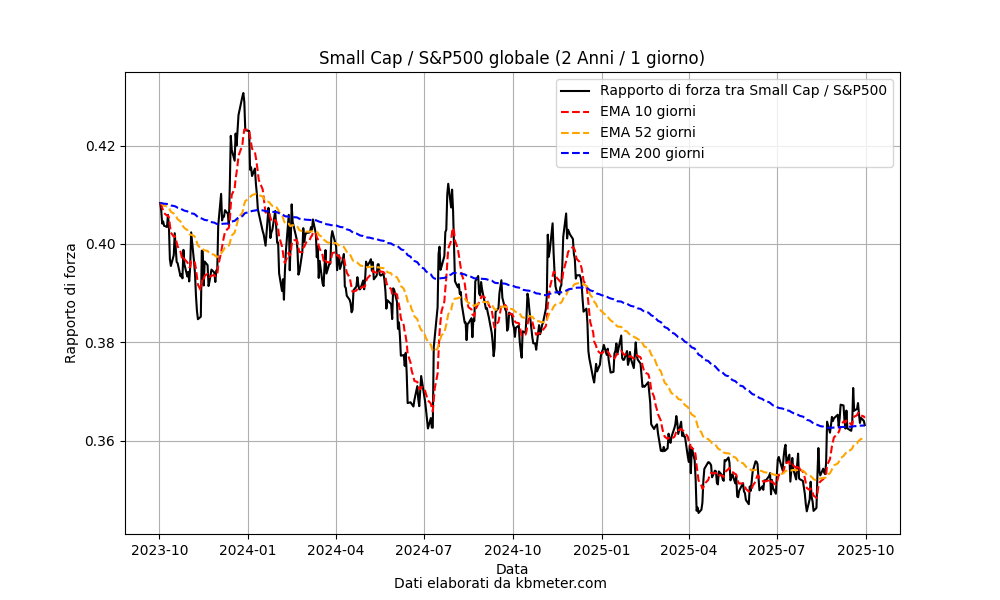

The situation is somewhat different for U.S. Small Caps. The chart above shows the relative strength ratio between the Russell 2000 small caps and the S&P 500. An attempt at a trend reversal has been in progress since last summer, with the indicator only in the past few weeks managing to recover above the long-term moving average.

The two charts above summarize what seems to be happening in the market. Initial enthusiasm regarding the pace of U.S. interest rate cuts appears to have significantly diminished, amid signs of persistent inflation and still-positive macroeconomic indicators. The continued, albeit slower, recovery of Small Caps seems to indicate a low expectation of recession for the U.S. economy.