Oil Falls, but U.S. Refineries Outperform the S&P 500

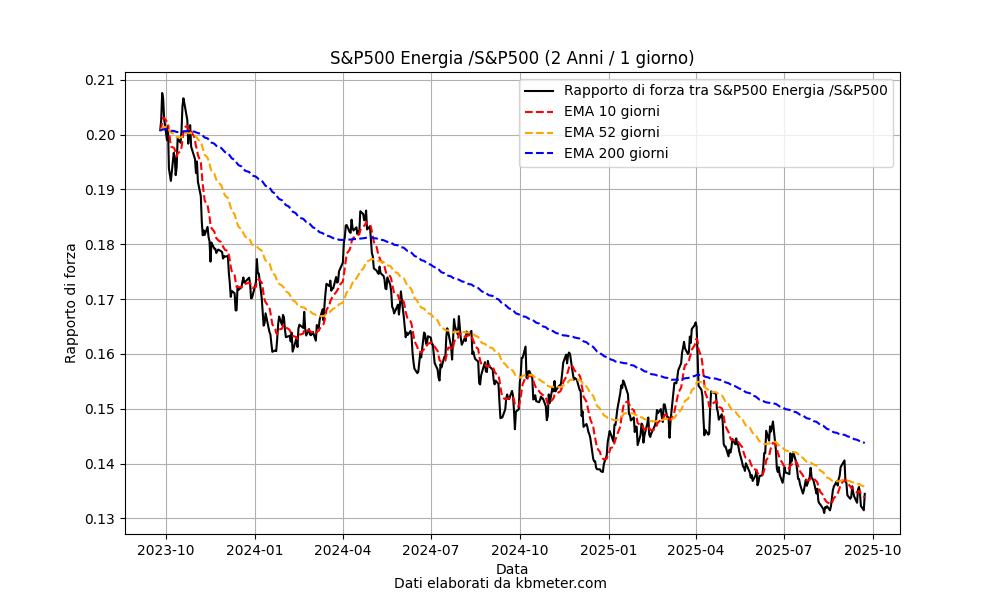

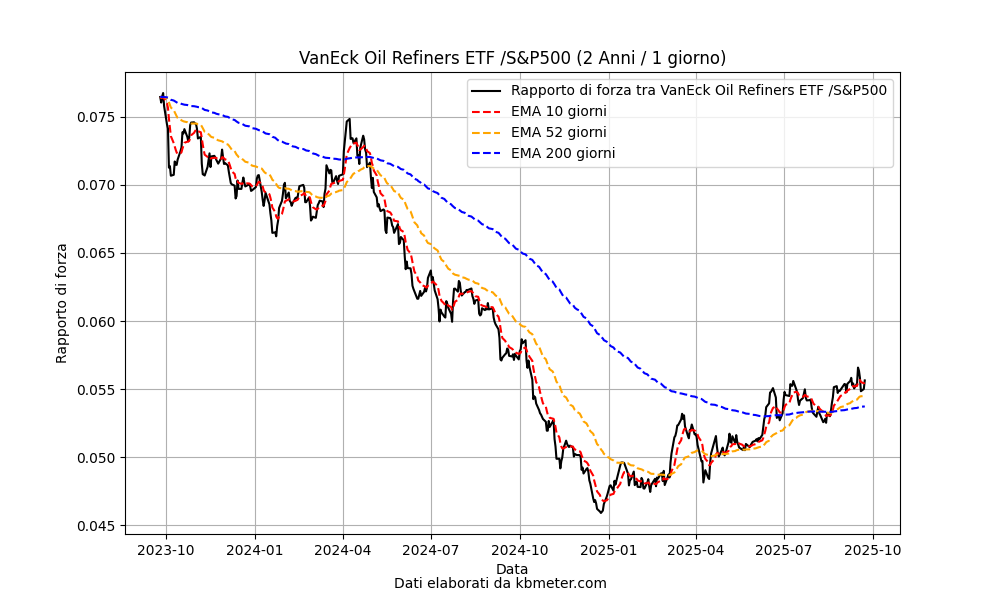

In the U.S., shares of oil refineries are outperforming the S&P 500 amid falling crude prices and potential exemptions related to renewable fuels. This represents a small market niche (accounting for 3% of the index) within a sector—energy—that remains weak.

The cold numbers show that since December 2024, with WTI crude oil prices falling by nearly nine percent, the U.S. crude refining industry has posted a performance of over 30%; over the same period, the S&P 500 gained about 13% (data source: Bloomberg).

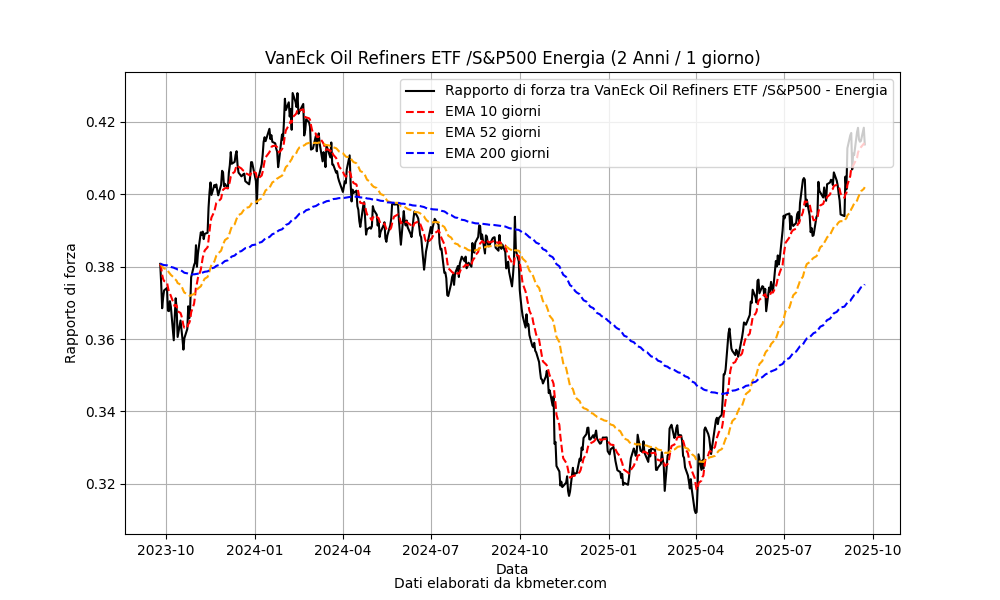

Looking at the relative strength ratio between the ETF investing in this industry and the S&P 500, we can see that since the beginning of 2025 there has been a trend reversal, with the indicator rising and crossing above its long-term average. This is a sign of strength for the oil refining industry, which becomes even more evident when compared solely to the U.S. energy sector.

Traditional energy companies, often referred to as “old economy,” have adopted more conservative strategies, focusing on higher returns on investment and debt reduction. These practices have led to greater financial stability and superior performance compared to other sectors, despite oil prices not being at previous high levels.

Some analysts also cite a new proposal from the Trump administration, which would exempt small refineries from the renewable fuels standard, providing relief to the margins of this market niche.

In any case, the energy sector remains weak, and oil price prospects are still oriented downward.