Latin American Equities Continue Their Recovery in 2025

After last spring’s slowdown, Latin American equities have continued their recovery phase that began in January 2025, driven by major markets such as Brazil and Mexico, but also by the surprising performance of Colombia.

Since the beginning of the year, the iShares Latin America 40 ETF has gained more than 30%, compared with a more modest 13% from the S&P 500. The rally has been particularly strong in some countries—for instance, Colombia has led year-on-year gains, followed by Mexico, Chile, Brazil, and Peru.

Supporting this region’s strong performance are, without a doubt, the trend of the U.S. dollar and the solid performance of many commodities (especially agricultural products). In addition, some Latin American stocks started from relatively low valuation levels.

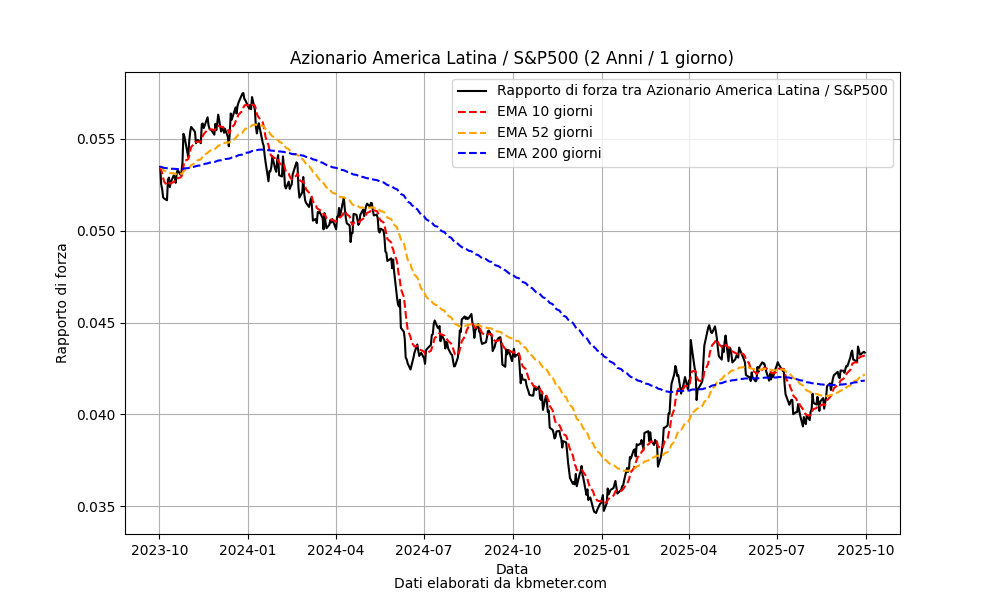

The chart above shows the relative strength ratio between the index of the 40 leading listed companies in Latin America and the S&P 500. The trend reversal from early 2025 is evident, followed by a slowdown coinciding with the announcement of the new U.S. trade policy. Subsequent developments on tariffs and the renewed weakness of the dollar have pushed the indicator back above its long-term moving average.

Volatility in this geographical segment remains high, and short-term uncertainties are not lacking. Chief among them is Argentina’s delicate situation.