Hang Seng Outperforms in Asia, but Investors Remain Cautious

The Hong Kong stock market is experiencing a particularly positive phase, with the Hang Seng Index revisiting its highest levels since 2022 and posting the best year-to-date performance among Asian stock exchanges. Expansionary policies and a renewed appetite for technology stocks are among the main drivers of this upward movement.

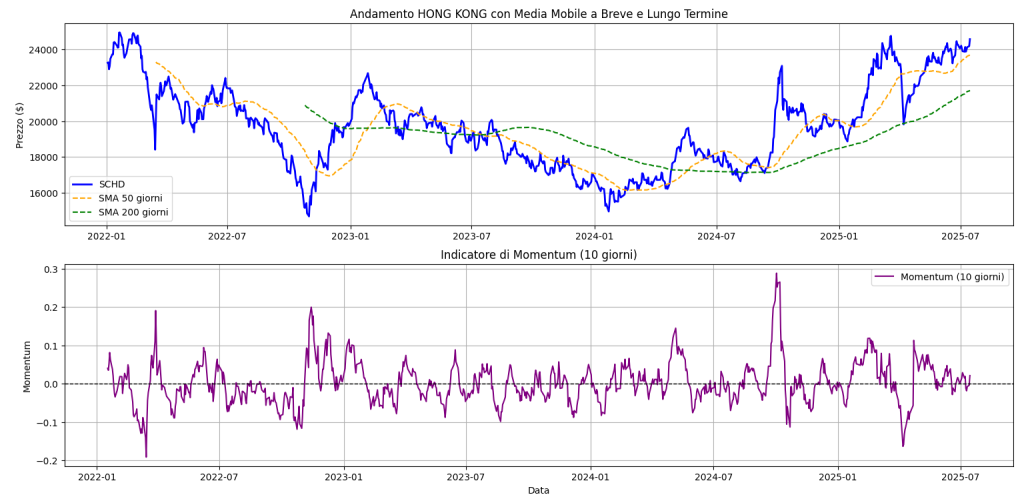

In the chart above, we observe the performance of the Hang Seng Index over the past three-plus years. A gradual strengthening is evident from mid-2024 onward, marked by the bullish crossover of the 50- and 200-day moving averages and the return to levels last seen in early 2022.

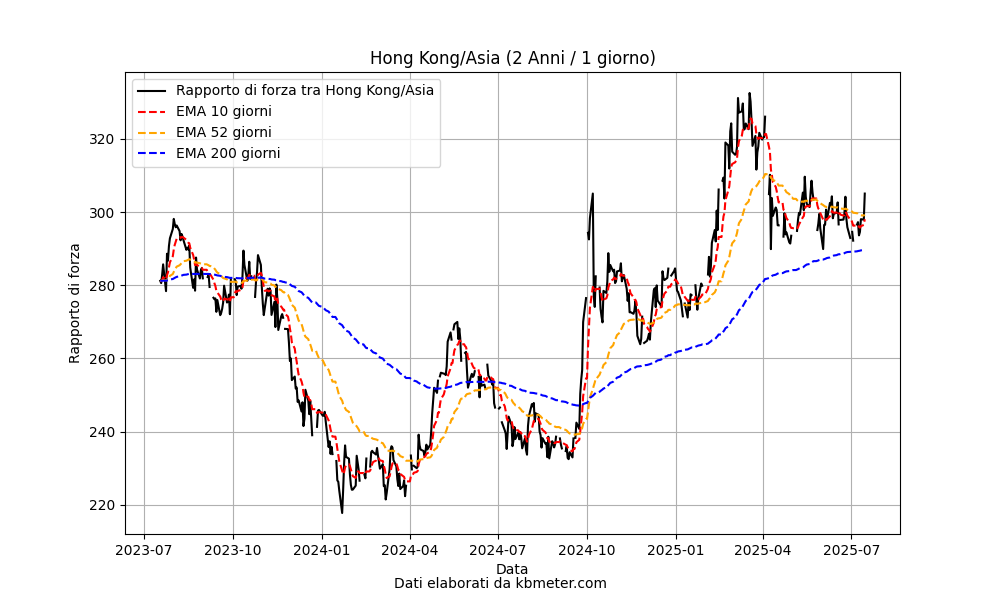

This performance has made the Hong Kong market one of the top performers in Asia, with a 23% gain since the beginning of the year. In the chart above, we also see the relative strength between the Hang Seng and the Vanguard FTSE Pacific ETF. It shows how the Hong Kong index began to outperform from late summer 2024.

The recent momentum has been primarily driven by renewed investor confidence in the technology and real estate sectors, fueled by expectations of looser Chinese policies, including rate cuts and fiscal stimulus. Major Chinese tech companies have also benefited, recovering ground after periods of high volatility.

Sentiment has improved thanks to early signs of economic stabilization, particularly in consumption and the flexibility shown by the People’s Bank of China—what some are calling a “whatever it takes” moment. However, as the recent slowdown in relative strength suggests, many investors remain cautious: analysts note that despite the rally, the index’s rise has not yet led to a significant return of capital to the IPO market or a broader credit expansion.