Gold Holds Strong Against Copper in September

Tariffs, interest rate expectations, and views on U.S. economic growth are reflected in the performance of the Gold-to-Copper ratio. The indicator remains upward-oriented, signaling a preference for the safe-haven asset and some uncertainty over the strength of industrial demand.

Gold has reached historic levels above USD 3,580/oz, marking an increase of more than 44% compared to the same period last year. Forecasts suggest a generally bullish trend for gold, with year-end expectations above USD 3,000/oz and potential highs in the USD 3,600–4,000 range over the coming months.

Copper has shown more modest performance, trading around USD 4.5/lb, with annual growth of roughly 11–13%. Following a record plunge in late July 2025, triggered by the removal of tariffs on certain U.S. imports of semi-finished copper, copper prices have stabilized within a narrow range.

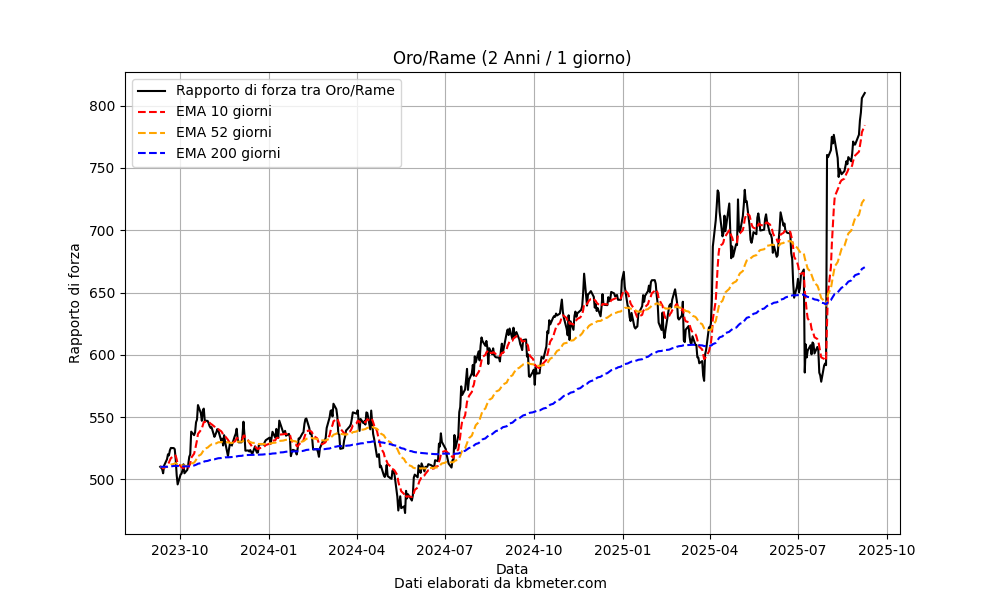

In the chart above, we can observe the trend of the Gold/Copper ratio over the past two years. Focusing on recent months, the sharp acceleration and subsequent drop in copper between June and July, driven by the tariff issue, are clearly visible. Afterwards, the trend resumed its upward path, fueled by gold’s strong rally amid expectations of a Fed rate cut. The medium- to long-term trend remains favorable to bullion.

Interpreted as an intermarket indicator, the Gold/Copper ratio in September continues to send a signal of uncertainty about the potential for economic growth in the coming months.