Asian equities buoyed by Fed moves

Over the course of the year, and especially in the past few weeks, Asian equity markets have delivered impressive performances. The main driver behind these gains has been expectations of a substantial Fed intervention on interest rates by the end of the year.

Expectations regarding the U.S. Federal Reserve’s interest rate decisions, U.S.-China trade negotiations, and the monetary policies of Asian central banks have been the key factors shaping the performance of Asian equities in recent months. The Japanese Nikkei 225 has reached new all-time highs, supported by a tech rally and the reduction of U.S. tariffs on Japanese exports. Indian markets, on the other hand, have benefited from optimism around U.S. trade talks and expectations of Fed rate cuts. South Korean stocks hit record highs thanks to a rally in semiconductor producers.

Overall, the MSCI Asia Index has gained over 27% year-to-date, an attractive return when compared to the MSCI World (+approximately 15%) or the S&P 500 (+approximately 12%).

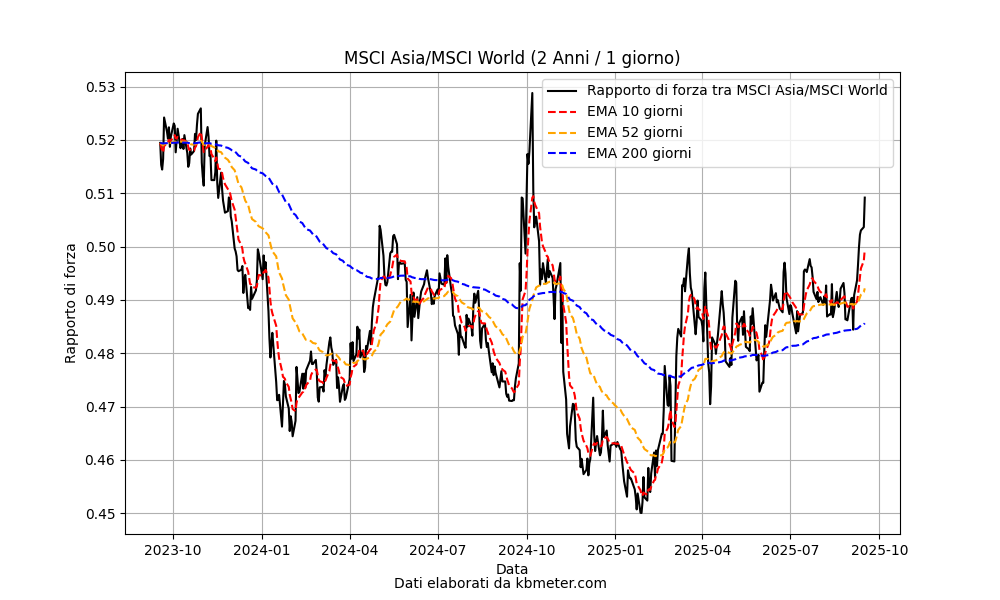

In the chart above, we can observe the strength ratio between Asian equities and World equities, calculated using two ETFs that track the performance of the respective indices. Notable is the crossover of the 50-day moving average with the 200-day moving average—a bullish signal—that occurred around last April, followed by a highly volatile but positive trend that continues to this day. The sharp rise in recent weeks has been driven primarily by expectations of rapid interest rate cuts by the U.S. Federal Reserve. Such moves would lower financing costs globally and provide relief to pressured bond markets