Short week for financial markets, amid the Fed and potential updates on U.S. tariffs

The week in financial markets opens without any major catalysts. Investors are clinging to the “dovish” remarks from some Fed governors and are awaiting developments on the tariff front (Supreme Court decision). Equities remain uncertain with futures trending higher, bonds are in wait-and-see mode, and commodities are mixed. Volatility is stable.

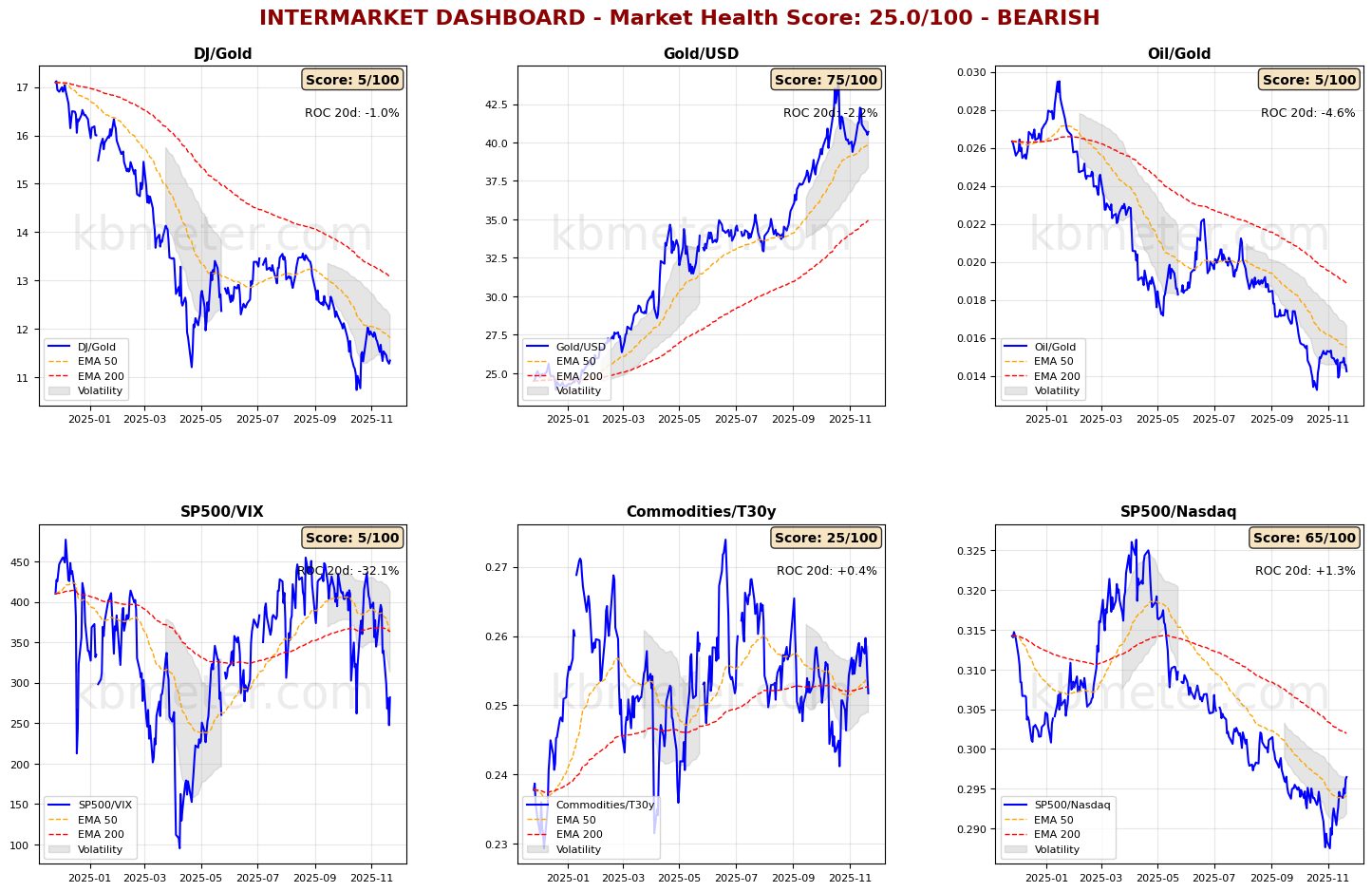

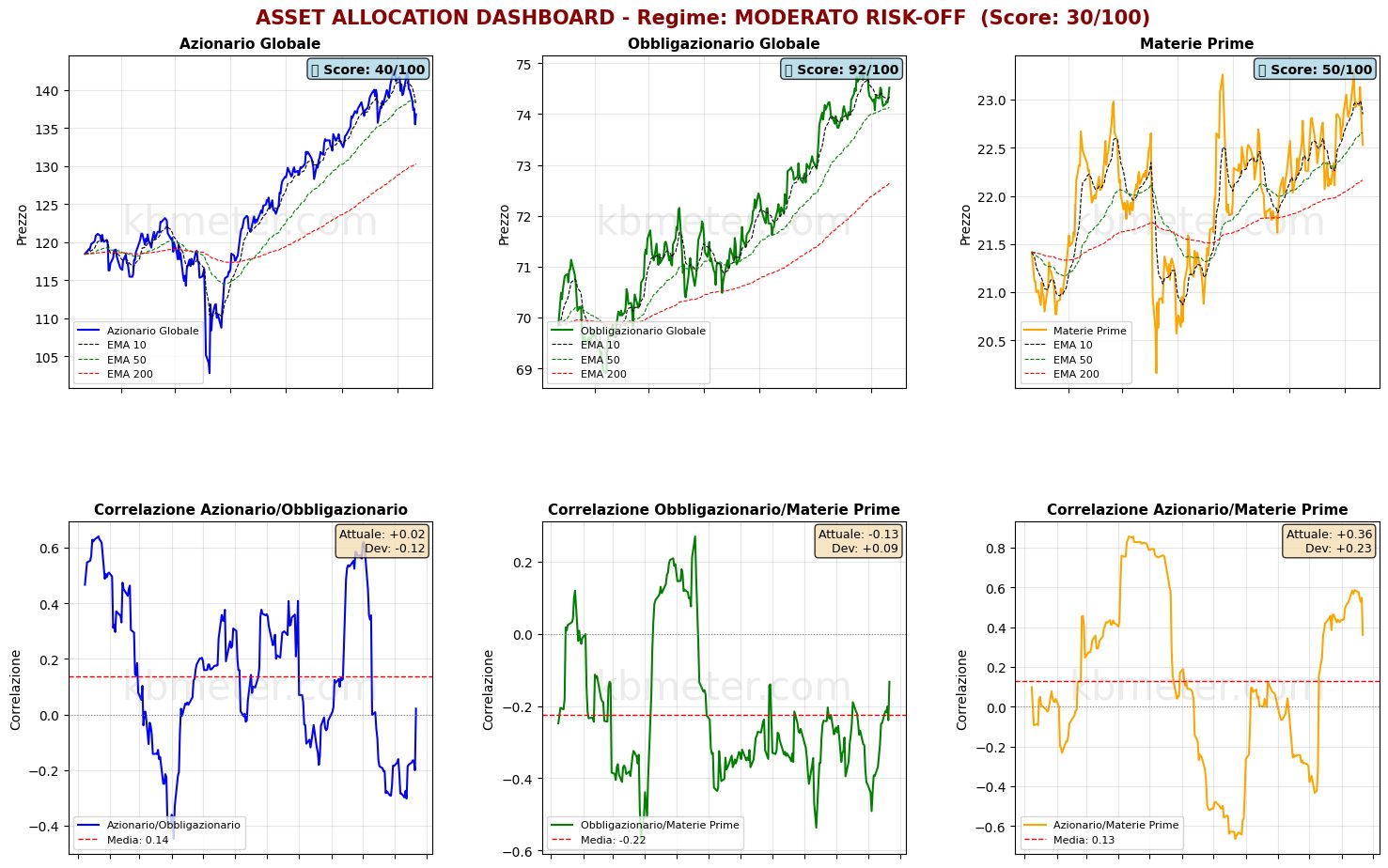

No significant changes are emerging from our intermarket dashboards. The situation continues to be characterized by a moderately risk-off sentiment.

On the macroeconomic front, the day features few data releases capable of moving markets. Noteworthy is the German business confidence reading for November.

Our forward-looking analyses still indicate an uncertain day for equity markets, with few firmly positive catalysts and many signs of caution. A mixed picture persists for bonds and commodities. Volatility is expected to remain stable.

In brief

A neutral day is expected for equities

A neutral day is expected for US equities

A neutral day is expected for European equities

A neutral day is expected for Asian equities*

A neutral day is expected for bond yields

A neutral day is expected for commodities

A day with stable volatility is expected

Here's an overview of the individual assets analyzed…

Already a subscriber? Login here