Financial markets remain focused on earnings reports, and the issue of U.S. tariffs resurfaces

Uncertainty continues to dominate financial markets, with investors still searching for clues from earnings reports and the few macroeconomic data releases expected. The tariff front is also reopening, with a possible intervention by the Supreme Court that could either dismantle Trump’s trade policy or further prolong the period of uncertainty. Equities are expected to recover, bonds remain in wait-and-see mode, and volatility is stable.

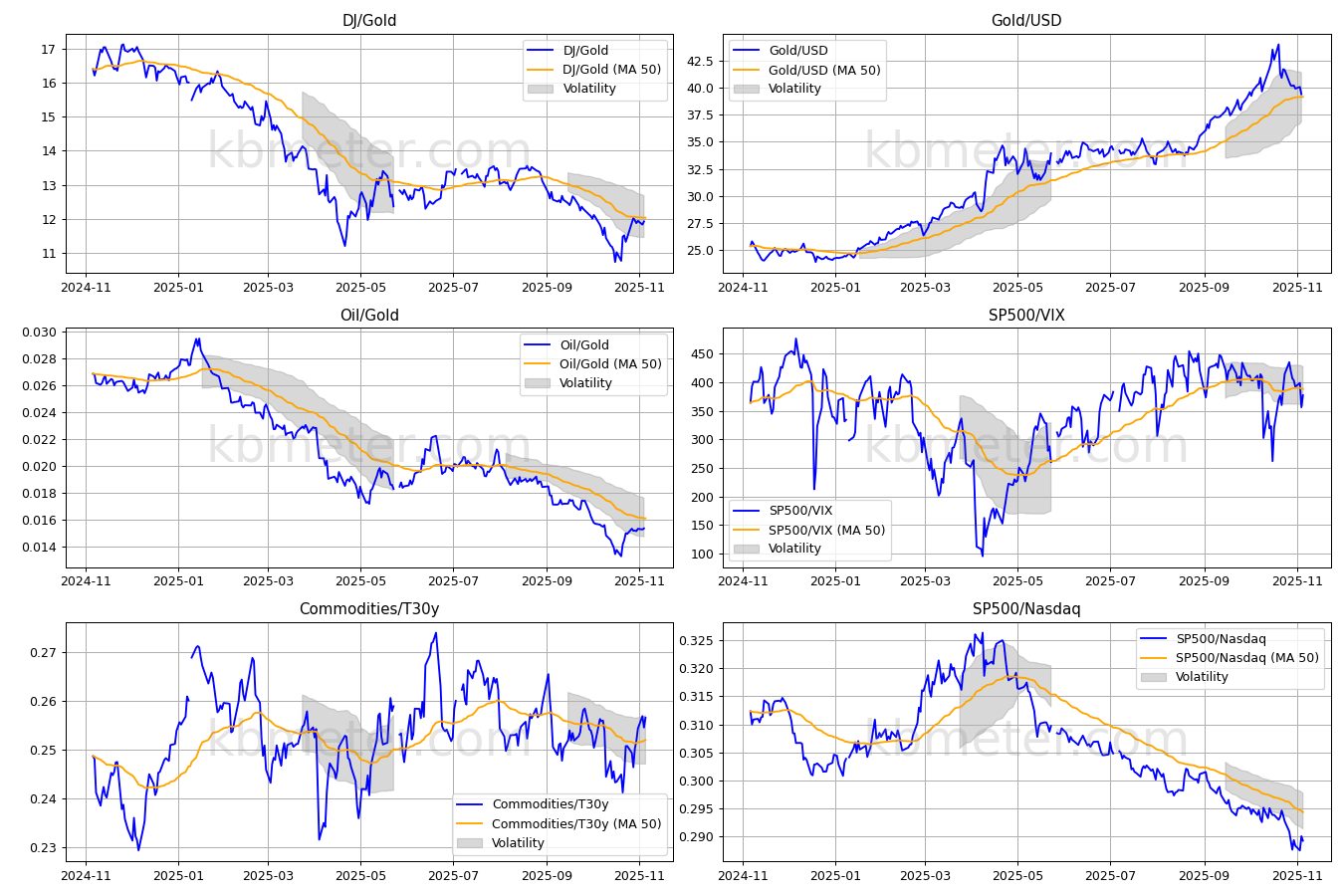

There are few changes in our intermarket dashboards. Sentiment remains in neutral territory, and the wide swings in the S&P 500/VIX ratio confirm the high level of uncertainty surrounding the markets at this time. Global bonds should be monitored as they approach the 50-day moving average, a technical support area.

On the macroeconomic front, today is the Bank of England’s meeting day. Retail sales data in the Eurozone, Spanish industrial production, and U.S. job-cut announcements will also be of interest.

As for earnings, all eyes today are on AstraZeneca and Airbnb.

Our forward-looking analyses indicate a broadly positive day for equity markets, while the outlook appears more uncertain for bonds and commodities. Volatility is expected to remain stable or slightly lower.

In brief

A positive day is expected for equities

A positive day is expected for US equities

A positive day is expected for European equities

A neutral day is expected for Asian equities*

A neutral day is expected for bond yields

A neutral day is expected for commodities

A day with stable volatility is expected

Here's an overview of the individual assets analyzed…

Already a subscriber? Login here